Secure Your Future: Retirement Planning with Financial Planners

At Financial Planners, we understand that retirement planning is a crucial aspect of securing your financial well-being. Our comprehensive approach ensures you have a clear roadmap to a comfortable and fulfilling retirement, tailored to your unique circumstances and aspirations. Located at 18 Adderley Street, Floor 3, Cape Town, Western Cape, 8001, South Africa, we're dedicated to helping you navigate the complexities of retirement planning with personalized guidance and expert advice. Contact us at +27 (21) 460-1234 or [email protected].

What is Retirement Planning?

Retirement planning involves strategically managing your finances to ensure you have sufficient funds to maintain your desired lifestyle after you cease working. This encompasses various aspects, including saving, investing, managing debt, and planning for healthcare expenses. Ignoring these crucial elements can lead to financial insecurity during your retirement years. We assist you in developing a tailored plan that addresses all your retirement needs.

Our Retirement Planning Techniques

At Financial Planners, we utilize a multifaceted approach to retirement planning. Our techniques are grounded in thorough financial analysis and personalized strategies:

- Comprehensive Financial Assessment: We begin by conducting a detailed assessment of your current financial situation, including assets, liabilities, income, and expenses. This provides a clear picture of your financial standing and identifies areas for improvement.

- Investment Strategy Development: Based on your financial profile, risk tolerance, and retirement goals, we develop a tailored investment strategy. This includes selecting appropriate investment vehicles, such as retirement annuities, unit trusts, and tax-efficient investment options.

- Retirement Projection Modeling: We use sophisticated software to project your future retirement income, helping you understand whether your savings and investments are on track to meet your goals. This allows for proactive adjustments if necessary.

- Tax Optimization Strategies: We help you minimize your tax liability through various strategies, maximizing your retirement savings and ensuring a higher net income.

- Estate Planning Integration: Your retirement plan is seamlessly integrated with your estate planning strategy, guaranteeing a smooth transition of assets to your beneficiaries.

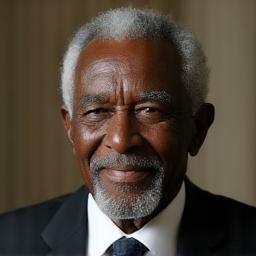

Case Studies: Real-Life Success Stories

While we maintain client confidentiality, we can share general examples of how our strategies have helped clients achieve their retirement goals:

- A self-employed professional couple, nearing age 50, initially felt overwhelmed by the prospect of retirement. Through comprehensive financial planning, including debt management and strategic investment planning, we helped them develop a realistic retirement plan that enabled them to retire comfortably at age 60, maintaining their desired lifestyle.

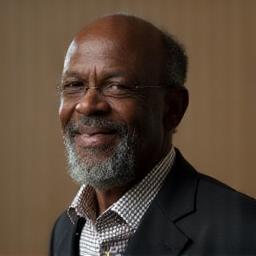

- A single mother, facing a potential shortfall in her retirement savings, sought our expertise. We helped her develop an aggressive savings and investment plan, coupled with adjustments to her lifestyle, enabling her to achieve financial security in retirement.

Resources for Your Retirement Journey

We believe that knowledge is power. That's why we offer various resources to empower you on your retirement planning journey:

- Free Retirement Calculator: Access our online calculator to estimate your retirement needs based on your current financial situation.

- Retirement Planning Guide: Download our comprehensive guide detailing various aspects of retirement planning and providing helpful tips. (available for download on our website)

- Seminars and Workshops: Regularly attend our seminars and workshops to learn from expert financial planners and network with fellow retirees. (details on our website)

Contact Us Today

Take the first step towards a secure and fulfilling retirement. Contact Financial Planners today for a free consultation. We're committed to helping you build a plan that reflects your aspirations and ensures your financial well-being for years to come. Contact us at +27 (21) 460-1234 or [email protected]. Let us help you plan your future with confidence.